You probably thought I'd forgotten about my plan to blog the home buying process. Not quite. I've just been a bit slower about it than I should have been.

So here's where things stand. While back home for the holiday I had a chance to think about this a bit more and do some more looking to see what's available. Here's what I've decided based on what I know today. I'm looking at a condo or town house in the South Bay. I'd like to stay within a 20-30 minute commute to work, but that's not a hard and fast requirement. I could always telecommute a bit more often. The price range I'm looking in is $350,000 - $415,000. An actual house is out of the question for that range and requires more work.

What you're reading is, of course, all subject to massive change if I come across better information.

The Financial Incentive

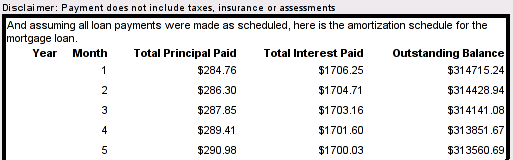

Here's what really got me motivated: the tax break. Let's use some round numbers and say that I buy a place for $415,000 and to do so I put down a $100,000 down payment. That means I need a $315,000 loan. Assuming I take that loan over 30 years at, let's say, a 6.5% interest rate. According to the calculator at interest.com, I'd have a monthly payment of $2000 if you round it up a bit. (I currently pay $1,300 in rent.) As you can see below, the vast majority of that $2000 is interest--at least initially. That's how these loans work. (Click here or on the table below to see the first 2 years.)

After the first year, I've paid $3,520.78 of the loan principal and a whopping $20,371.34 in interest. To put that in perspective, I currently throw $15,600 down the tubes every year in rent. Over the last 4 years, that totals $62,400.

That $20,371.34 interest is a tax deduction. Assuming I pay the federal government more than that much in taxes (I do), it's a huge savings. Rather than throw away $15,600 every year in rent and over $20,000 in taxes, which total over $35,000, I get to divert the majority of the tax money toward paying for the new place. [NOTE: That's not quite right, as you'll read below.]

Yes, yes, I know. This is an over-simplification. What about property taxes? That's money I'm not currently spending. Fine, add in several thousand dollars a year for property taxes. And a bit more for home owners insurance. And the inevitable Home Owner's Association (HOA) fees. And maintenance.

Well, there are a lot of little things that will certainly add up. Even if, in the end, I end up spending just as much money as I do today, that's okay. I'll have a larger place to live, probably in a nicer neighborhood, and I'll be building equity. In theory, I'll be able to sell the place sometime in the future for at least what I paid for it.

Yes, it's a gamble. The local real estate market could tank and I'd get screwed. But I'm willing to take that gamble.

Now, what about specifics of this place?

Rooms

It seems that I can find something with 2 bedrooms and 2 bathrooms without too much trouble. I really only need one bathroom and would love a 3rd bedroom, but let's not get greedy. And I'm really not picky about the living room, dining room, etc. I would like lots of windows and ample storage.

Parking

This is probably what's going push me toward the upper end of my price range. At a minimum I'd like a 1 car garage. Not just a carport or parking spot. A real garage. And I'd be willing to pay extra for a 2 car garage. I like having a lot of storage space for all the crap I've managed to accumulate.

Location

I'm looking in Santa Clara, San Jose, Sunnyvale, Mountain View, Cupertino, and nearby areas. As long as it's close to some of the major highways (85/101/280/237) I should be okay. I might consider going a bit farther like, say, Fremont.

Other Stuff

I'd like AC but probably won't get that lucky. I can always get ceiling fans installed before moving in. After all, there are really only about 10 days each year when I'd really need the cooling help.

I must be able to get Cable or DSL there--preferably both.

I'd really like a first floor unit.

The place must have laundry hookups. If it doesn't actually have a washer and dryer, that's fine. I'll get my own (again).

The fun begins...

UPDATE: Yes, I know I screwed up and forgot to note that it's a percentage of the theoretical $20,000 that I save, not all of it. Read the comments below for more.

Posted by jzawodn at January 07, 2004 04:39 PM | edit

I'm not sure how tax deductions work down in the US of A, but I think up here a $20K tax deduction wouldn't mean you get $20K back of the taxes you've paid. At best it would mean you can deduct the $20K off your total taxable income, and then be taxed on the lower income. So maybe $2.5K of your tax money would come back out of this.

Either way, I have to look this up here in Canada because it is something that could influence purchasing a house (which I'm sure we'll be looking into soon).

This sounds like a lot of the same thinking I went through when we bought our first house. However, a small math correction on your tax-thinking. The interest payments, are "deductible", not a "tax deduction". In other words, you subtract the interest payments from your taxable income and then figure out the tax on what's left. You *do not* subtract the interest payments from the amount of tax you owe. It's a common misconception among first-time home-buyers. In the end, it's still a great incentive to buy. If you can swing it, it definitely beats renting.

Other inputs: (a) do get a 2nd bathroom, it's a lot easier to resell than a 1-bath, (b) same for A/C.

Hope that helps and good luck to you.

Attention: tax-advice comment collision avoidance failure detected.

Of course, you're right. I mis-wrote about the tax stuff. I wrote this at 3am 2.5 weeks ago and posted it without re-reading.

Whoops.

But you get the idea. I'll get a percentage of the interest back.

I actually *have* been thru this before. I owned a house about 5 years ago in Ohio.

Next time, sanity check old content *before* posting.

I've heard housing is expensive down there, but damn. $350,000 - $415,000 and you're just hoping for a garage and AC? Incredible.

Best of luck!

My one piece of advice: make sure you can make extra payments on your loan at any time and it goes towards your principal, and not along the existing n-year schedule. I believe that's pretty standard, but watch out.

Brad: Yes, it is nuts here.

I occasionally made extra payments on my house in Ohio. It was a good feeling to know I was actually making a dent in the prinicpal once in a while. :-)

You might want to email me and get together for coffee. I live in (own) a townhouse in Mountain View for over five years--2 br, 2 ba, ceiling fans, carport--and am actually (a big enough sucker to volunteer as) president of the HOA. Glad to share.

You might want to spend the time to really expand your search radius. The further you get from the Peninsula, the more you'll get for your money.

I'm ~35 minutes from work, off-peak commute. ACE Train is an option. Just as an example, these are nearby in the new part of Dublin. The Amalfi starts at 419k.

Definitely right about buying a house -- paying off someone else's mortgage sucks, and yeah, all the tax benefits are optimised for home-owners (if the US is anything like Ireland in that respect).

But yikes, those prices are _insane_ ;)

BTW -- remember the #1 rule, which really does apply: location. If it's got a good location but only one bathroom, or no AC, or needs a bit of fixing up, or is missing a roof, it's probably still worth it -- because all those things can be sorted out with the application of a little money and time, and will increase the value.

(OK, I'm joking about the roof part.)

Also, I presume damp and dry rot aren't an issue in CA? What about termites? Is there any serious danger sign that means "run away" over here?

Justin:

Termites are a problem in the Bay Area from what I've seen and heard.

Condos are definately a winner. Scary to think of 450K though, my first condo was a 2BR, ground floor, 900sq feet for $55K CDN. Mortgage, tax, and condo fees ended up being slightly above what I was paying in rent. (And there are no tax advantages to owning in Canada)

Not sure if the condo laws in the States are the same as Canada, but when looking for a condo make sure to look at the status of the reserve fund. The benchmark up here is something like $1,000CDN/unit. If a roof blows off it comes out of the reserve fund, if the fund isn't enough, the board imposes a levy.

Sean

first of all, don't move to fremont. you'll hate yourself after the first week of commuting. and don't fall into the milpitas trap.

i lived in s'vale for 4 years (while my company moved from mt view to s'vale to santa clara and back again to s'vale) and it sucked my will to live. the apartments and condos there are nothing more than industrial park buildings with more doors and bathrooms.

mt view near castro would be close to light rail and caltrain. or what about palo alto within biking distance to the mt view light rail and palo alto caltrain. palo alto will be one of the caltrain bullet train stops -- 30 minutes to the city!

what about a 2 or 3 bedroom condo and a roommate?

or 3 or 4 bedroom house with roommates?

think resale value.. a $450k condo in s'vale will lose value much quicker than a $600k house in palo alto.

Damn, I keep forgetting how much more expensive it is down there to buy a place. Up here in Central Oregon we're buying another house (selling our current one)-- a 2431 square foot, 3 bedroom, 3 bath monster for well under $250K. No termite problems up here, either.

Our first house, which we bought 5 years ago, was for about $160K, and is about 1830 square feet, with 3 beds and 2.5 baths. And it's on a half-acre lot, too, nice and big.

It's just insane the difference. :-/

So, you have 100 thousand dollars sitting in the bank for a down payment? Or am I misunderstanding how this process works?

I wouldn't keep $100,000 in the bank. That's just silly.

We're getting ready to close on a house at the end of the month up here in Seattle. It's just under 400k with 3000 sq ft, 5 bedrooms, three baths, two car garage and 1/3 of an acre!

Not to rub your face in it. Of course, the weather is a bit different.

sometimes i'm glad to live in good old eastern Europe (sometimes i'm not :)

it's not too hard to have 30-50k US$/y [per family, especially when doing business on the internet], and your own house like 6000 sq ft, 5 bedrooms, three baths, two car garage and 1/3 of an acre would cost you about 100-150k max.

costs of living are lower too ... most people have income about 5000 usd/year ... you do the math how expensive is to live here

see you, guys ;)

$315-450K would get a very very nice huge house in most parts of the country.

take that $100K to vegas and try to grow it.

Wow, thanks for reminding me why I live in the midwest. Your planned downpayment of $100,000 is more than 1/2 the price of my house...

Two words: JUMBO MORTGAGE.

I forget the current cut off point, but the last time I was in the RE market it was ~$240K.

In case you don't understand JUMBO MORTGAGES, here's the scoop.

Nobody is going to give you a single loan for more than the JUMBO cutoff amount. Any amount above the cutoff number is technically packaged as a JUMBO and subject to a higher interest rate, usually 0.5%, to compensate for the increased risk of so much money sunk into one property.

Jeremy, you'll likely really want to look at the addon costs that you may not currently be carrying at your apartment (hydro, water, property taxes and sinking fees). We've looked at buying a house several times and each time we realise that the mortgage itself only works out to about half the yearly cost of the house.

Granted, we aren't looking in that price, especially since I'm about to move to Winnipeg where housing costs are as low as Eastern Europe, but still. Get a mortgage consultant if you're going into that price range. If you can convince them to seal the deal, it won't cost much more (maybe .5%) than getting a real estate agent to handle the sale, and you really won't regret it.

Oh, and good luck and congrats!

I'm sure you know this already, but when looking at bedrooms and bathrooms, think not just of yourself, but of the eventual resale of your house. I have a 5 bedroom house. I use 3 of those bedrooms now - the rest are there bc the house is a good investment.

If you possibly can, make sure you keep the mortgage under $322,000 -- this is the cutoff for a jumbo mortgage and will save you about 0.5% on the interest rate.

Steer clear of the people who offer 0 money down or 107% mortgages ('cos you'll need some money for drapes!).

Consider not getting an agent -- especially on a condo / townhouse you can probably save 3.5% on the price (the buying agents commision). You can always get an agent later to do the transaction for you if the sellers aren't willing to be reasonable. You probably don't need somebody driving you around and showing you houses.

Look at alot of places until you are sick of them. This will save you from the "first house I saw I liked" syndrome but beware the "next house I see, I'm buying" syndrome.

Read this book. You can have my copy if you want as I've bought a house already!

THE MOST IMPORTANT ADVICE

Real estate, mortgage and title people (caution sweeping generalization ahead) are stupid. There incompetence can sink you financially. You must know as much as they know and question everything or they will cut your throat with their incompetence. You would think they do this everyday a million times and it should be a cakewalk. It is not. You also need to be on the lookout for people who are trying to screw you over but on balance you have more to fear from incompetence than malice.

Good luck on your home search! Eventually it will be worth it!

My wife and I bought a place with almost the same requirements about two years ago. We ended up in a really nice condo complex in Sunnyvale. It's in your price range, 2 bedroom, 2 bath, and a 2 car garage. Right off 101. I'm not selling, but there is one place in the complex for sale.

I'm hesitant to put my address on a web page, so if you are interested please email me for more information.

That's it. I'm buying a townhome.

I have $25,000 saved thinking I will get that amount up to $50,000 before buying but I'm wasting rent. I've only lived in the Bay area for 5 years and the home prices still seem insane.

Thanks for triggering this.

Don't forget that the property tax you pay is also deductable. Or so our lawyer told us when we closed on our house in October (and so TurboTax told me when I did a rough first-cut on this year's taxes last weekend). What we did when figuring out how much house we could afford was to figure out how much we would save on taxes (my guess is about $600/month in your situation, Jeremy) and subtract that from the proposed mortgage+insurance+prop.taxes and compare that to what we were paying for rent+renters insurance every month. I was surprised at how much we were able to afford. Turns out the house we wanted (and ultimately bought) would only cost us net a couple hundred dollars a month more than the house we were renting, which was half the size of the one we bought.

As for the question of Jumbo loans, as noted before, it doesn't apply if Jeremy's really looking at putting $100,000 down, as the cutoff point for last year was $322,700 (it should go up slightly this year), but even if you need more than that, many banks are more than happy to do an 80/10/10, where you take a first mortgage for 80% of the purchase price, a second mortgage for 10%, and 10% down. You avoid PMI that way, saving a couple hundred dollars per month, and don't pay the Jumbo penalty. You get the ability to borrow about $40,000 more that way than if you restrict yourself to a single conforming loan.

Don't forget about the cost of furnishing the place. Being the owner sucks you into spending a fortune on mini blinds, coordinated bath mats and shower curtains, etc etc etc. It's easier if you can get Yahoo to just direct deposit your paycheck to Home Depot :)

I think there are alot of considerations in deciding how much of a home is too much. A good book to read would be Rich Dad/Poor Dad. It is a best seller and helps in giving perspective to this question of how much is too much for ONE property as an asset.

I am considering purchasing a 1 bedroom/1 bathroom Condo in Playa Del Rey, CA for 400 thousand. I am putting 100 thousand down so I can keep my monthly payment lower. Should I bail or proceed? This is my first time purchasing. The location is desierable and this very condo sold 2.5 years ago for 240. Am I nuts?????